The latest news of interest to multifamily owners of apartment buildings in Oregon and Washington.

Build Your Legacy with HFO, a member of GREA.

Monday, December 30, 2019

Eudaly Won't Support Residential Infill without Added Tenant Protections

Multifamily Marketwatch Podcast - December 30, 2019

A round-up of the affordable housing positions of some of the US Democratic Presidential candidates is featured.

Friday, December 20, 2019

Survey: Portland Renters Face Discrimination when Applying for Housing

Thursday, December 19, 2019

When Scammers Pose as Landlords, Things Go Sideways

Multifamily NW, Tenant Landlord Attorney Leah Sykes Resign from City's Rental Services Commission

Tenant Advocates Prep for Next Push in Washington Legislature

UN Climate Report: End Apartment Bans to Save the Planet

According to the sightline institute in its review of key report findings, millions of Americans would happily reduce their own carbon emissions by living smaller and closer in, with nicely insulated new windows and nice thick walls, if only local zoning allowed it.

Washington Legislature Could Consider Lifting Rent Control Ban, Eliminating No Cause Evictions in 2020

Better Housing by Design Approved by Portland City Council

Monday, December 16, 2019

Supreme Court Declines to Hear Boise Case on Prosecution for Homeless Camping

Friday, December 13, 2019

Portland Narrows Definition of "Retailer" for Clean Energy Tax

Thursday, December 12, 2019

The Cascadia Region Has Too Many Large Housing Units

New Oregon Law on Applicant Screening Fees Takes Effect January 1, 2020

Beginning January 1, 2020, there are changes to Oregon Revised Statutes 90.295 relating to charging applicant screening fees.

The law now states: “A landlord may only require an applicant to pay a single applicant screening charge within any 60 day period, regardless of the number of rental units owned or managed by the landlord for which the applicant has applied to rent.”

Although this may be simple for landlords using only one set of screening criteria for all of their properties, it is much more complex for landlords with multiple screening criteria, especially when managing affordable housing. It also poses challenges for larger landlords managing many portfolios with applicants submitting applications at multiple sites. In those instances, we advise a company-wide system to allow for monitoring applications from various sources.

Additionally, rules governing screening charge refunds were clarified and are consistent with general industry practices. Landlords must refund applicant screening charges within a “reasonable time” if the landlord fills the vacant unit before screening the applicant or doesn’t screen the applicant. Landlords utilizing waitlists should refrain from processing screening charges until the applicant is the next available person on the waitlist.

Damages for failure to comply with this section are twice the amount paid by the applicant, plus $150. If you have any questions about your specific situation, please make sure you speak to an attorney to stay in compliance with this regulation.

Study: Rent Control Will Restrict Apartment Development, Resulting in Lower Tax Revenue for Cities

NAA’s analysis shows that these policies decrease the housing supply, harm the condition of existing housing stock and lower property values, which leads to lower tax revenues. These policies ultimately limit job growth and negatively affect local economies.

Read the summary.

Read and download the full 9-page report.

Tuesday, December 10, 2019

Seattle Councilmember Kshama Sawant proposes ban on residential evictions during winter

Olympia Landlords Say Proposed Renter Protections May Increase Rents

Friday, December 6, 2019

PSC Narrowly Votes to Require Developers Build Space for Tents in New Design Guidelines

Thursday, December 5, 2019

Multifamily Development Trends in Portland, Oregon with HFO Senior Broker Lee Fehrenbacher

Tuesday, December 3, 2019

An Update on the Multifamily Market on Portland, Oregon's Eastside with Senior Broker Jack Stephens

Monday, December 2, 2019

Entire Floor of Tenants Forced to Relocate from City-Owned Apartment Building

Tuesday, November 26, 2019

How Does an Oregon Landlord Issue No-Cause Terminations for Repairs and Renovations Under SB 608?

Monday, November 25, 2019

HFO Marketing Director Named Chair of New Local Nonprofit Working to Build Trust Between Community, Police

An Update on Portland, Oregon's Economy and 2020 Forecast with State of Oregon Analyst Christian Kaylor

Houston, We Have A Solution: How Houston is Curbing Homelessness

Multifamily Marketwatch Podcast - November 25, 2019

Portland government pays $350 thousand in attorneys fees to unreinforced masonry owners for their successful legal challenge against the city; a professor argues that residential infill will only succeed if homeowners are good at being landlords and the Seattle Times reports that despite much fanfare in 2017, Seattle's BLOCK project has built only 9 backyard ADUs for homeless residents.

Friday, November 22, 2019

Prof. Ethan Seltzer: City Should Do More to Support New Landlords

Ethan Seltzer, Emeritus Professor in the Toulan School of Urban Studies and Planning at PSU, wrote guest commentary in the City Observatory blog this week calling on the City of Portland to do more to support the new, small landlords who will be necessary once the Residential Infill Project is implemented. RIP is expected to increase the number of lots with multiple units substantially over the next few years, and many of these new units will be rentals. But Portland and the State of Oregon have implemented policies recently that make it more difficult for landlords to operate. Seltzer argues that while larger landlords may be able to hire lawyers or raise rents to cover costs, smaller landlords who own fewer than 4 units may avoid the risk by renting their units through AirBnB, or solely to friends and family. He suggests the city could negotiate supportive lease agreements for smaller landlords, or create neighborhood groups that could act as management associations. Read more.

Ethan Seltzer, Emeritus Professor in the Toulan School of Urban Studies and Planning at PSU, wrote guest commentary in the City Observatory blog this week calling on the City of Portland to do more to support the new, small landlords who will be necessary once the Residential Infill Project is implemented. RIP is expected to increase the number of lots with multiple units substantially over the next few years, and many of these new units will be rentals. But Portland and the State of Oregon have implemented policies recently that make it more difficult for landlords to operate. Seltzer argues that while larger landlords may be able to hire lawyers or raise rents to cover costs, smaller landlords who own fewer than 4 units may avoid the risk by renting their units through AirBnB, or solely to friends and family. He suggests the city could negotiate supportive lease agreements for smaller landlords, or create neighborhood groups that could act as management associations. Read more.For more information on the multifamily market and PSU's Real Estate Program, be sure to watch Greg Frick's interview with Dr. Gerard Mildner. You can find this interview and more on our website, or on Youtube.

Monday, November 18, 2019

Multifamily Marketwatch Podcast - November 18, 2019

This week: after declining 80% in the recession, homebuilding finally rebounds; the cities of Lake Oswego and West Linn try to find ways around a new state law requiring multiple housing units, and the Washington State Supreme Court upholds one of Seattle’s latest housing laws.

Portland-Area Rents Mostly Flat Month-over-Month, but Milwaukie Is Still Seeing Strong Growth

Thursday, November 14, 2019

Washington Supreme Court Upholds Seattle's First-Come, First Served Law

Wednesday, November 13, 2019

Portland City Council Votes Unanimously to Expand Deconstruction Rules

Tuesday, November 12, 2019

Seattle Adopts New Tenant Protections

Read more here.

Monday, November 11, 2019

City Council Finishes Public Hearing on Better Housing by Design; Written Testimony Accepted Through Nov. 21st

Better Housing by Design E-UPDATE: November 8, 2019

City Council finishes public hearing on Better Housing by Design proposals – will consider amendments on November 21

City Council finished hearing public testimony on the Better Housing by Design Recommended Draft on Wednesday, November 6, 2019. The public hearing started at 2 p.m. and lasted until 5 p.m. 42 people provided testimony during the three-hour hearing. Much of the testimony was on draft amendments requested by City commissioners. A lot of testimony was about whether or not to limit development bonuses for affordable housing based on transit access. There was also a lot of testimony regarding parking exemptions for affordable housing, and a broad range of perspectives were shared on proposals related to historic preservation.If you missed this hearing, you can view a video of the hearing here. In total, community members have contributed over 250 pieces of written or verbal testimony on the Better Housing by Design proposals.

Written testimony will continue to be accepted through November 21, 2019. You can provide testimony on the broader Recommended Draft proposals, as well as on the draft amendments. Please see below for information on how to submit testimony.

Next Up – Amendments

City Council will discuss and vote on potential amendments to the Recommended Draft on November 21, 2019, starting at 3:45 p.m. in Council Chambers at City Hall. The amendments they will consider include those previously requested by commissioners (see below), as well as any new amendment requests that may emerge from commissioners’ consideration of recent public testimony. Any revisions to the list of draft amendments will be posted online prior to the November 21 session. The public is welcome to attend the November 21 City Council session on the amendments, although this will not be a public hearing.

Learn about the draft amendments

- A table summarizing the draft amendments requested by commissioners (as of November 5) can be found here.

- The full amendments package with complete code language and commentary is here.

- Updates to the list of potential BHD amendments will be posted here: https://www.portlandoregon.gov/bps/80031

These potential BHD amendments include:

- Amendments to the Deeper Housing Affordability Bonus to provide options for affordable ownership housing.

- Expanded exemptions from minimum parking requirements for projects providing affordable housing.

- Limitations on using development bonuses on sites where historic buildings have been demolished in the multi-dwelling and mixed-use zones.

- Prohibitions on using development bonuses on sites more than a 1,500-foot walking distance of frequent-service transit.

- Disallowing 100-foot building height in the RM4 zone in historic districts.

- Requirements for large sites to include indoor common areas, such as community or recreation rooms.

- Zone changes in the King’s Hill Historic District to reduce allowed building scale.

How to Testify

Written testimony will continue to be accepted through November 21, 2019 (you must include your name and address):Use the Map App:

www.portlandoregon.gov/bps/mapapp

Select Better Housing by Design and click on the "Testify" button. Testifying in the Map App is as easy as sending an email. And once you press “submit,” you can see your testimony in the Testimony Reader in real time. You can also read other people’s testimony.

By U.S. Mail:

City Council

Better Housing by Design Testimony

1221 SW Fourth Avenue, Room 130

Portland, Oregon 97204

Links to Recommended Draft documents:

Recommended Draft Summary - Short summary of the Recommended Draft’s major proposals

Volume 1: Staff Report - Summary and analysis of Recommended Draft Zoning Code and Map amendments

Volume 2: Zoning Code Amendments – Recommended Draft Zoning Code and Comprehensive Plan full text and commentary

Volume 3: Additional Zoning Code Amendments – Zoning Code amendments updating other chapters for consistency

Maps

Citywide maps showing the Recommended Draft Zoning Map and Comprehensive Plan Map can be viewed here:

Map of Recommended Draft Zoning

Map of Recommended Draft Comprehensive Plan Designations

Learn about how the Recommended Draft multi-dwelling zoning changes will affect specific properties by using the online Map App: www.Portlandmaps.com/bps/mapapp

Select Better Housing by Design and enter an address to learn about the proposed zoning for a property.

You can find all the Recommended Draft material online at: https://www.portlandoregon.gov/bps/79578

Draft BHD amendments material: https://www.portlandoregon.gov/bps/80031

For more information

• Project website: www.portlandoregon.gov/bps/betterhousing• Email: betterhousing@portlandoregon.gov

• Bill Cunningham, Project Manager, 503-823-4203

The Bureau of Planning and Sustainability is committed to providing meaningful access. For accommodations, modifications, translation, interpretation or other services, please call 503-823-7700 or use City TTY 503-823-6868, or Oregon Relay Service 711. 503-823-7700.

Wednesday, November 6, 2019

Portland Housing Bureau Sets Public Hearing for Thursday 11/7 on Rental Screening/Deposit Administrative Rules

the Portland Housing Bureau for rules slated to take effect March 1, 2020.

The Portland Housing Bureau is releasing two sets of Administrative Rules:

- Rental Housing Application and Screening Process establishes rules for PCC 30.01.086

- Rental Housing Security Deposit Process establishes rules for PCC 30.01.087

These two sets of rules provide additional clarity to the public on the implementation of the FAIR ordinances and create forms and notices required by the ordinances. The public is invited to testify on both proposed drafts. Drafts of the proposed changes, as well as notices and meeting information, can be found at www.portlandoregon.gov/phb/FAIRrules.

Paper copies are available at the Portland Housing Bureau at 421 SW 6th Ave, Suite 500.

Submitting Testimony

You can submit testimony or feedback on the drafts. Testimony may be submitted via email, fax, letter, or in person at a public hearing. Written comments or testimony must be received by December 4, 2019 and must include a first and last name to be considered.

- Email your testimony to RentalServices@portlandoregon.gov

- Fax your testimony to 503-823-2387

- Mail your testimony to PHB c/o FAIR Rules 421 SW 6th Avenue Suite 500 Portland, OR 97204

- Testify in person at the public hearing: Thursday, November 7, 2019, from 3-5 pm at the Portland Housing Bureau - 421 SW 6th Avenue, #500, Portland, OR 97204

Monday, November 4, 2019

Multifamily Marketwatch Podcast - November 4, 2019

This week: the Federal Reserve and interest rates; Oregon and Washington politicians promise to work together on the Interstate Bridge project and a new government report on climate change and real estate.

Thursday, October 31, 2019

Fed Cuts Interest Rates for Third Time in 2019

Tuesday, October 29, 2019

U.S. Census Releases Rental Vacancy Rates for Q3 2019: Seattle ranks 10th, Portland 11th Lowest

The U.S. Census Bureau reports that the third-quarter 2019 rental vacancy rate for the Portland/ Vancouver/ Hillsboro metro area was 4.7%, an increase of 0.2% from one year earlier. This is close to the recently released Multifamily NW fall survey of nearly 62,000 area apartment units which pegged area vacancies at 4.4%.

Seattle/Tacoma/Bellevue's metro area vacancy rate was listed at 4.6%, down 0.7% from a year ago.

The nation's lowest rental vacancy rates, by metro area:

- Allentown-Bethlehem-Easton, PA-NJ - 0.0%

- Worcester, MA - 1.1%

- Minneapolis-St Paul - Bloomington, MN-WI - 2.0%

- Buffalo-Niagra Falls, NY , and Grand Rapids-Wyoming, MI - 2.8%

- San Francisco-Oakland-Hayward, CA - 3.3%

- San Jose-Sunnyvale-Santa Clara, CA - 3.7%

- Los Angeles-Long Beach-Anaheim, CA - 3.9%

- Akron, OH - 4.0%

- New York-Newark-Jersey City, NY-NJ-PA - and Toledo, OH - 4.3%

- Seattle-Tacoma-Bellevue, WA - 4.6%

- Portland-Vancouver-Hillsboro, OR-WA / Jacksonville, FL / Bridgeport-Norwalk, CT - 4.7%

The average national rental vacancy rate for Q3 2019 was 6.8 percent for multifamily dwellings of five or more units -- down from 7.1% one year earlier, despite continuous delivery of multifamily units throughout the national market.

Year-over-year vacancy rates in the Western U.S. decreased, from 5.1% to 4.8%.

|

| Click to Enlarge |

U.S. Homeownership Rate Falls

After falling to a 26-year low in 2016, the homeownership rate has rebounded and has increased slightly over the past year to 64.8%. Homeownership in the West has also increased from 60.2% in Q3 2018 to 60.6% in September 2019.

|

| Click to Enlarge |

Monday, October 28, 2019

Multifamily Marketwatch Podcast - October 28, 2019

This week: the City of Portland repeals its placard and tenant notification requirements for unreinforced masonry buildings; real estate and construction professionals in the pacific northwest questioned in a recent survey were concerned over environmental regulation, affordable housing, and rent control. And it turns out that the exodus of residents from California may not be wealthy retirees after all.

Thursday, October 24, 2019

Portland City Council Repeals URM Placards, Convenes Committee to Reduce Seismic Risks

Tuesday, October 22, 2019

ULI Emerging Trends in Real Estate 2020 Breakfast in Portland

Keynote speaker Andy Warren, Director of Real Estate Research at PwC, emphasized that the differences between the top 20 metro areas for real estate investment are shrinking. This year, Portland was ranked 20th on the list, while Seattle was 10th. Denver dropped from 10th place last year to 17th this year. Warren commented on the rising phenomenon of "hipsturbia," or millennial hipsters moving to suburbs while expecting walkable urban amenities like bars, breweries, and flexible work spaces. He also emphasized that cities that have invested in infrastructure are the most attractive to investors. According to the Emerging Trends in Real Estate survey, 81% of real estate professionals cite transportation as the most important infrastructure investment a city can make.

Following Warren's presentation, Matt Miller of Greater Portland Inc. moderated a panel featuring Warren, Expensify Founder David Barrett, Bridge Economic Development President Alisa Pyszka, and Eastdil Secured Senior Vice President Mark Washington. The panel discussed Portland's strengths and weaknesses, as well as what the city will need to do in the future to foster economic growth.

Barrett recently moved his company from San Francisco to Portland, which he said was primarily a lifestyle decision. He did not look at school districts or taxes, but instead was drawn to Portland because of the character of its neighborhoods, and its proximity to wine country and outdoor recreation. He urged the developers and planners in the audience not to imitate San Francisco's pattern of development in which urban campuses close themselves off and shut out the local community.

Other panelists, including Alisa Pyszka, emphasized that Portland needs to work on growing its economy from within and focusing on educational opportunities that rely less and bringing in talent from other cities. They also discussed the "trailing spouse" factor - if people move here for job opportunities, will their spouses also be able to find jobs in their field that will keep them in the region?

In terms of barriers to entry and feasibility, the panelists agreed that while local investors may feel that the political and regulatory environment in Portland makes investment and development difficult, investors from larger cities tend to view the city as a relatively untapped market that presents an opportunity for creative options. This was borne out in the survey, which ranked Portland as the #1 city for investment opportunities.

Wednesday, October 16, 2019

City of Portland Upcoming Workshops for Multifamily Owners on Rental Screening and Other Laws

The traveling helpdesk is available to provide technical/non-legal assistance on Saturdays at the Multnomah County Library branches and dates listed below:

October 2019

19th - Capitol Hill 10:30 am - 12:30 pm

19th - Belmont - 2:30-3:30 pm

November 2019

2nd - Holgate 10:30 am - 12 pm

2nd - Gregory Heights 1-3 pm

9th - Midland 10:30 am - 12:30 pm

9th - St. Johns 2-4 pm

16th - Capitol Hill 10:30 am - 12:30 pm

16th - Hollywood 1:30-3 pm

December 2019

7th - Holgate 10:30 am - 12 pm

7th - Gregory Heights 1-3 pm

14th - Midland 10:30 am - 12:30 pm

14th - St. Johns 2-4 pm

21st - Capitol Hill 10:30 am - 12:30 pm

21st - Belmont 2-3:30 pm

Tuesday, October 15, 2019

Portland Metro Area Rents Decreased in September, but Rents in the Valley Are Picking Up

Monday, October 14, 2019

Multifamily Marketwatch Podcast - October 14, 2019

This week: Under orders from a Federal Judge, the Portland City Council will have a public hearing October 23 on the court's mandated rollback of its ordinance requiring placards on unreinforced masonry buildings; and the Supreme Court is deciding whether to hear a case challenging the legality of inclusionary zoning.

Wednesday, October 9, 2019

Washington Multifamily Housing Association Releases 2019 Legislative Summary

Tuesday, October 8, 2019

City Council to Consider Repealing URM Placard Requirement October 23rd

Monday, September 30, 2019

HFO-TV: Federal Judge Orders Mayor Wheeler, Commissioner Hardesty to Appear in Court if Council Fails to Comply

City of Portland Better Housing by Design plan for Apartment Buildings - Public Hearing Oct. 2, 3 pm

The Better Housing by Design project is part of a broader Housing Opportunities Initiative that includes the residential infill project and a new anti-displacement action plan effort.

The public hearing is scheduled for 3 pm on Wednesday, October 2nd at Portland City Hall. Three hours have been allotted for the hearing. Discussion and vote will take place at a subsequent council meeting.

Want to comment but can't make the hearing?

Testimony may be submitted online through October 2nd using the online map app.

Thursday, September 26, 2019

Allowable Rent Increase in Oregon for 2020 Will Be Lower than 2019

Monday, September 23, 2019

Washington Post Editorial Board: Populists Are Wrong, Rent Control Does Not Help Cost-Burdened Renters

Wednesday, September 18, 2019

HFO Named Among Area's Most Generous Corporate Philanthropists

| |

| Tien Nguyen, Nick Quandt and Rachel Reuter |

Each year, the Business Journal ranks the most generous corporate philanthropists in four categories. For years HFO has ranked among the top 25, but this year marks the third time HFO has been in the top 10 for area businesses with annual revenue of $10 million or less.

HFO regularly contributes to charity for each transaction in the client’s honor. We created a corporate matching fund that makes annual year-end donations to nonprofits selected by brokers and staff.

HFO’s top charities in 2018 were:

$5,000 - Outside In

$5,000 - Morrison Child and Family Services

$1,000 - Meals on Wheels

For 2019 HFO’s top charities are:

$5,000 - Face 2 Face Portland

$5,000 - Girls Inc.

HFO Brokers and staff particularly enjoy volunteering annually at the Oregon Food Bank.

Pictured here (L-R) Rachel Reuter and Donna Brunner.

Below: (L-R) Stephen Wendt and Rob Stigle.

Thursday, September 12, 2019

California Passes Statewide Rent Control

The President of the National Multifamily Housing Council, Doug Bibby, issued the following statement in response:

"The most effective way to fix California’s housing crisis is by building more housing across a range of price points and AB-1482 makes that harder to do. After Californians overwhelmingly rejected the rent control ballot initiative less than a year ago, lawmakers today went against their constituents by passing a measure that will discourage investment, shrink the availability of affordable housing that already exists and squeeze even more people struggling in the housing market. This makes the problem worse. The housing affordability crisis is real, real Americans are being harmed by it every day and we need real solutions – not restrictive policies that we know don’t work.”

Tuesday, September 10, 2019

The Apartment Industry and Residents Contribute $3.4 Trillion to the National Economy

The report indicates that 328,000 new apartment homes are needed each year to meet demand, but producing that housing requires new approaches to development, more incentives, and fewer restrictions.

Recent apartment construction has contributed more than $150 billion to the national economy and created 752,000 jobs.

Areas with high to moderate barriers to new apartments include Seattle and Portland.

- All four sectors of the industry have posted very strong growth, punctuated by the construction industry ramping up to meet the unprecedented demand for apartments this cycle – reaching a height of 346,900 completions in 2017, up from 129,900 in 2011.

- Previous research by Hoyt Advisory Services found that we need to build an average of 328,000 apartments per year at a variety of price points to meet existing demand, which would bring continued economic activity. This number of multifamily completions has only been surpassed twice since 1989.

- Hoyt research also found that a significant portion of the existing apartment stock will need to be renovated in the coming years, boosting spending in the renovation and repair sector.

- The combined contribution of apartment construction, operations, renovation, and resident spending equals $3.4 trillion per year, or more than $9.3 billion daily.

Monday, September 9, 2019

Despite Evidence That It Improves Returns, Commercial Real Estate Industry Lags on Diversity and Inclusion

Friday, August 30, 2019

Rent Increases in Portland Metro Are Beginning to Pick Up Again

Can a Landlord say "No Guns" in a Rental Lease?

Wednesday, August 28, 2019

Seattle's Multifamily Market Boom Continues

Tuesday, August 27, 2019

RentCafe: Rents Increases in Oregon Outpace National Average in July

Wednesday, August 14, 2019

Funding of OneApp Oregon through Rental Services Fee Receives Criticism from Landlord and Tenant Groups

Thursday, August 8, 2019

Minneapolis Rejects Single Family Zoning, But Is It Enough to Improve Affordability?

Wednesday, August 7, 2019

Portland City Council Approves $60 Per Unit Annual Fee for Rental Housing

The city council passed the fee over the objections of landlords, who testified a week earlier that the charge was a tax that would be passed on to renters since all the services it supports were for renters. Read more.

Monday, August 5, 2019

Developer Switches Lloyd Condo Development to Market Rate Rentals

Despite Ongoing Construction, Seattle and Portland's Rental Vacancy Rates Remain Among Nation's Lowest

The U.S. Census Bureau reports that second-quarter 2019 rental vacancy rate for the Portland/ Vancouver/ Hillsboro metro area was 4.1%, a drop of 0.7% from one year earlier.

Seattle/Tacoma/Bellevue's metro area vacancy rate was listed at 3.3%, down 0.8% from a year ago.

The nation's lowest rental vacancy rates, by metro area:

- Cleveland, OH - 1.5%

- San Jose, CA - 2.0%

- Columbus, OH - 2.2%

- Boston - 2.9%

- Allentown-3.2%

- Seattle/Tacoma/Bellevue - 3.3%

- Akron - 3.6%

- Riverside, CA 3.7%

- North Port, FL - 3.9%

- Rochester, NY 4.0%

- Portland/Vancouver/Hillsboro - 4.1%

- Denver - 4.4%

- Salt Lake - 4.4%

- L.A. 4.5%

The average national rental vacancy rate for Q2 2019 was 6.8 percent for multifamily dwellings of five or more units -- no change from one year earlier, despite continuous delivery of multifamily units throughout the national market.

Year-over-year vacancy rates in the Western U.S. decreased, from 5.1% to 4.8%.

|

| Click to Enlarge |

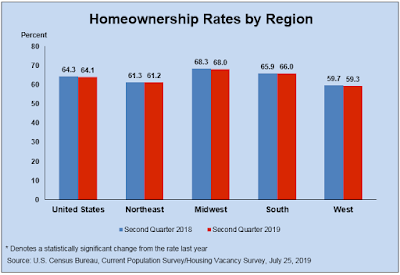

U.S. Homeownership Rate Falls

After falling to a 26-year low in 2016, the homeownership rate has rebounded but fell slightly over the past year to 64.1%. Homeownership in the West has also decreased from 59.7% in Q2 2018 to 59.3% in June 2019.

|

| Click to Enlarge |