(NMHC Research Notes - Summary)

There are widespread consensus among economists that rent control is a failed policy, as it reduces the quantity and quality of available housing. There are also documented negative consequences to rent control, including poor targeting of benefits, decreased property maintenance, and a decline in rental housing supply.

Despite this consensus among economists, many states have introduced rent regulations that limit rent growth under different names, such as "rent stabilization" or "anti-gouging" laws. Proponents argue that these new regulations are less restrictive compared to traditional rent control policies because they allow for increases tied to inflation, aiming to promote renter stability and affordability without the adverse effects of absolute rent ceilings. However, opponents contend that these terms are often used interchangeably, and the underlying concept remains the same: government intervention in setting rental prices.

Here are some specific examples of "rent control" and "rent stabilization" laws in different states. See if you can guess the difference!

1. New York City:

New York City has one of the most well-known and restrictive rent control programs in the country. The program, which dates back to the 1940s, applies to apartment units built before 1947 and continuously occupied since 1971. Rents are limited to a "Maximum Base Rent" adjusted every two years to reflect changes in operating costs. The Housing Stability & Tenant Protection Act of 2019 further tightened allowable rent increases in controlled units. In 2017, the median rent for a one-bedroom apartment under rent control was just $840, significantly lower than the median market-rate rent of $2,555.

2. Washington, DC:

Washington, DC has its own rent stabilization laws. The current iteration, effective since 2006, caps rent increases by the lesser of inflation (Consumer Price Index) plus 2 percent or 10 percent. However, the law is not universal, exempting units in buildings with fewer than five units and those built after 1975. The original rent regulation in DC also allows for vacancy decontrol, enabling owners to raise rents by a maximum of 10 percent in between tenants or up to 30 percent if an identical unit in the building rents for that amount.

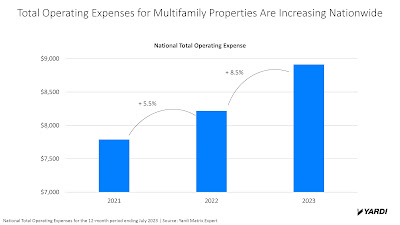

Recently, the DC Council passed legislation that further limits annual rent increases in stabilized units to 6 percent for the next two years. This change was made in response to a spike in rents in mid-2022 after the COVID pandemic. However, the legislation does not consider the rising costs of property insurance and other non-controllable expenses faced by housing providers.

3. California:

In 2019, California implemented the Tenant Protection Act, which is framed as a rent stabilization law. The act caps rent growth at the lesser of 5 percent plus inflation or 10 percent. However, similar to other jurisdictions, if inflation exceeds the cap, housing providers cannot raise rents accordingly. The law exempts rental units built within the last 15 years, as well as certain condos, single-family homes, and two-unit properties. Efforts have already been made to make the law more restrictive, with proposals to reduce the limit on rent increases to the lesser of inflation or 5 percent.

4. Oregon:

Oregon also passed a rent stabilization law in 2019. The law currently limits rent growth for multi-unit properties to 7 percent plus inflation. This means the maximum allowable rent increase under the law would be 14.6 percent. Similar to California, the law exempts multi-unit properties older than 15 years. Recently, Senate Bill 611 was passed in Oregon, further lowering the limit on rent increases to the lesser of inflation plus 7 percent or 10 percent.

These examples highlight the limitations and exemptions within rent stabilization laws in different states. Despite the variations in terminology and some adjustments to the regulations, the fundamental issues and criticisms associated with rent control persist. Rent stabilization laws:

- Impose rent ceilings without considering the actual costs of maintaining rental housing

- Fail to address the needs of vulnerable populations

- Do not create new housing supply to reduce market rents

- These laws are often not universally applied, exempting certain types of rental units from the regulations.

In conclusion, rent control and rent stabilization policies, whether under different names or with minor adjustments, are failed concepts that do not effectively address housing supply issues.