Download the latest HFO Newsletter update, which looks back on market conditions and transactions in Q2 2024:

2023-2024 Newsletter Updates: Year-End 2023 | 2024 Q1 | 2024 Q2

The latest news of interest to multifamily owners of apartment buildings in Oregon and Washington.

Build Your Legacy with HFO, a member of GREA.

Download the latest HFO Newsletter update, which looks back on market conditions and transactions in Q2 2024:

2023-2024 Newsletter Updates: Year-End 2023 | 2024 Q1 | 2024 Q2

Drawn by HFO’s industry leadership, Tiffany Wright brings extensive real estate and operational expertise to her new role

PORTLAND, OR, April 29, 2024 – Marking its 25th anniversary with a significant step towards future growth, HFO Investment Real Estate, a Pacific Northwest-based real estate brokerage specializing in multifamily real estate, is excited to announce the appointment of Tiffany Wright as Chief Operations Officer. This strategic addition underscores the firm's commitment to expanding its leadership and enhancing its service in the multifamily real estate sector.

Tiffany Wright reflects on her appointment, "Joining HFO was influenced by the firm’s reputation for top talent and leadership in the industry. I am thrilled to help drive growth at a company that values robust relationships and innovative solutions. The alignment of HFO’s commitment to excellence with my professional goals and values presents a compelling pathway to contribute meaningfully."

Bringing a wealth of experience from her tenure as President of CPX, a commercial real estate investment firm covering Portland and Seattle (now a part of Northmarq), Tiffany is well-prepared to spearhead operational enhancements and elevate HFO's service standards. Her prior leadership over a diverse portfolio including commercial, multifamily, and manufactured housing assets positions her to lead HFO into a new era of industry prominence, and her transition to HFO from a successful career spanning early childhood education to executive roles across the Western United States and India highlights her versatile leadership and deep commitment to fostering lasting relationships.

As HFO celebrates a quarter-century of success, Tiffany Wright’s role will be pivotal in steering the company through its next phases of growth and achievement. Her unique perspective and strategic insight are expected to play a crucial role in maintaining and expanding HFO's position at the forefront of the Pacific Northwest apartment brokerage industry.

For more information about HFO’s services and career opportunities, please visit HFORE.com.

About HFO Investment Real Estate

HFO Investment Real Estate is a Pacific Northwest-based real estate brokerage specializing in facilitating the acquisition and disposition of multifamily assets on behalf of a wide range of clients, from individual owners to institutional and private equity firms. HFO was founded in 1999 and has since earned a dominant share of the local market, consistently outranking its peers as a top broker in our PNW markets. In 2022, HFO joined several other brokerages throughout the U.S. to form GREA, a network of top-producing brokerages dedicated to providing a higher level of service and reliable high-level expertise to multifamily investors in every region.

For more information or to learn more about available listings, please visit HFORE.com.

Follow us on LinkedIn and Instagram for the latest listing and company news.

Brookshire Apartments is an 18-unit complex comprising four four-plexes and an original 1950s house converted into a duplex. Tucked away in Newport on the Oregon coast, the benefits of the property's desirable location were challenged by the need for various capital improvements, and several vacant units were not yet rent-ready. With occupancy below 70% at the time of sale, there was potential for management improvement. HFO assisted the buyer in navigating the complexities of financing for this operationally challenged property in a tertiary location. This transaction exemplifies HFO's adeptness and expertise in successfully closing challenging deals.

By HFO Investment Real Estate

Research

Following partner meetings with

dozens of institutional multifamily owner groups at the National Multifamily

Housing Conference in San Diego last month, it appears the multifamily housing

sector is entering a period of cautious optimism in 2024. For the most part,

institutional owners, whose multifamily assets are typically valued at $20

million and up, feel the prices of multifamily real estate are finding their

floor. Key factors contributing to this outlook include better clarity on

interest rates, operational costs, and the balance between supply and demand,

suggesting a more predictable market landscape. There's also a growing

acceptance that distress among institutional-grade properties will be minimal,

with many issues likely to be resolved privately or through debt restructuring.

The financial dynamics of

multifamily properties are evolving. Expense growth is expected to surpass

revenue increases in some markets this year. Property values are approaching a

low-water mark, with capitalization rates stabilizing. These dynamics suggest a

cautious market, with big-ticket investors adjusting their expectations. The

cautious market is expected to keep joint venture and institutional equity

mostly sidelined, with the bulk of capital investment in housing this year

coming from family offices and private individuals. A surprising and

significant increase in expenses the rental housing market faces is a surge in

fraudulent rental applications. According to an NMHC report released in

mid-January, more than 70% of major apartment landlords report increased

applications, highlighting a growing and significant issue impacting

operational costs and market integrity. This trend complicates rental

management and contributes to higher costs, ultimately affecting availability

and affordability.

With loan rates and expenses

up, construction starts are declining nationwide, including throughout the

Portland metro. Most of the area's new apartments will be delivered this year,

and there is very little slated for completion in 2025 compared to other

markets in the western region. This decline in new construction is occurring

despite a critical need for more housing. A strong job market, increasing

wages, and growing consumer confidence further increase demand. With

completions up in the near term, the strategy of "heads on beds"

emphasizing occupancy over rent increases still reflects the competitive

landscape, with operators willing to adjust prices to maintain high occupancy

rates. However, that strategy will end as construction deliveries slow later

this year. CoStar Analytics is now forecasting that rent increases will begin

again in the fourth quarter of 2024.

The government at all levels

now appears serious about addressing the need for additional housing. Last

week, the City of Portland issued largely temporary "regulatory

relief" on 15 zoning and permitting requirements that take effect March 1.

At the state level, Governor Tina Kotek recently announced she would seek $500

million during the current legislative session for housing-related

infrastructure and land-use expansions. At the federal level, a new bill

introduced in Congress on January 31 would spend $300 million to enhance the

supply of affordable housing.

In summary, the multifamily

housing market in 2024 is navigating through a phase of adjustment and cautious

optimism. Demand remains strong, but the challenges of supply, construction,

and operational dynamics persist. The introduction of legislation to bolster

the affordable housing supply and the need to address fraud in rental

applications are critical aspects of the broader effort to stabilize and

improve the market for renters and investors.

HFO Investment Real Estate is celebrating its 25th year

in business. HFO offers brokerage and advisory services to multifamily owners in

Oregon and Washington. Call (503) 241-5541 or visit www.hfore.com to learn more.

We're thrilled to announce the successful sale of Tigard York, a 52-unit garden-court apartment community in the heart of Tigard, a vibrant westside suburb of Portland. Kudos to Greg Frick, Rob Marton, and Tyler Johnson for navigating this complex transaction and helping a 1031-exchange buyer secure funding, showcasing HFO's ability to secure a successful outcome for all parties even amidst market challenges. 🚀💼

Check out more recent HFO transactions at HFORE.com.

On August 30th, a significant decision was made regarding Tacoma's rental housing landscape. A judge ruled against including the already-passed Measure No. 2, which expanded renter protections, on the November ballot as an alternative to the proposed "Citizens’ Initiative 2023-01." The Tacoma City Council had voted to include Measure No. 2 on the ballot as an alternative to the initiative, despite it being an existing law that wouldn't be impacted by the results of the vote.

Ballots will be mailed out on October 20th.

What is Citizens’ Initiative 2023-01?

The initiative aims to further refine the city's rental housing code, introducing more comprehensive rights for tenants than those provided by Measure No. 2.

Here are some of the proposed changes under the initiative:

Resident Fees:

Relocation Assistance:

Eviction Limitations:

What Does This Mean for Multifamily Investors and Owners?

The potential passage of Citizens’ Initiative 2023-01 could introduce a more regulated environment for multifamily property owners and investors. The restrictions on fees, the stringent requirements for rent increases, and the broadened eviction limitations could impact operational flexibility and profitability. It's crucial for stakeholders to be informed and prepared for these changes should the initiative pass.

What Can Multifamily Investors and Owners do to Make Their Voices Heard?

Stay tuned for more updates and in-depth analyses on this topic. If you're a multifamily investor or owner, understanding the nuances of such measures can be pivotal for your investment strategy.

Recent analysis by the real-estate technology platform Cadre reveals that for many Americans, renting might be the more economical choice given the skyrocketing costs of homeownership. With mortgage rates surpassing 7% and home prices at an all-time high, combined with fierce competition due to limited home listings, potential buyers are finding homeownership increasingly out of reach.

A comparison of owning versus renting costs shows the most significant disparity since 2000, with it being approximately 70% more expensive to buy a home than to rent as of August 2023.

Key Highlights:

Read more at MarketWatch.com.

Yardi Matrix is out with a new report on multifamily housing. Here are the highlights:

Construction Pipeline Falling

| |||

| Click to enlarge |

Transactions Slowing

Occupancy Flat

Population Aging

Rent Growth Slowing to Pre-Pandemic Levels

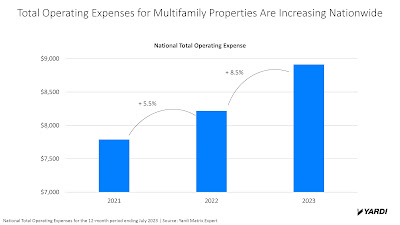

Operating Expenses Climbing Fast

|

| Click to enlarge |

The Portland City Council has unanimously approved a tax incentive aimed at retaining businesses in the city's downtown, Old Town, and Lloyd and Lower Albina districts. This credit, designed to reduce business license taxes, is available to companies with a minimum of 15 employees that sign or extend a lease for at least four years in the specified urban areas. To qualify, businesses must also ensure that their employees spend at least half their working hours in the city core. While the incentive caps at $250,000 per taxpayer, it's expected to be implemented for the 2023 tax year. City officials believe that even though smaller businesses might not directly benefit from the tax break, the increased foot traffic from larger businesses will indirectly boost their operations.

Andrew Fitzpatrick, the mayor's economic development director, and Andrew Hoan, president of the Portland Metro Chamber, both stressed the importance of the incentive in preventing businesses from leaving the city. Mayor Ted Wheeler and Commissioner Carmen Rubio, who played pivotal roles in formulating the measure, expressed optimism about its potential positive impact on the city's business landscape.

Key Highlights of the DBI Credit:

Read more at Portland approves downtown business tax break - Portland Business Journal (bizjournals.com)

Dive Insight reveals that Ltd. Spring Run, constructed from over 880 prefabricated modules, will span six residential buildings on a 24-acre plot. These units will be almost fully finished upon arrival, with only utilities, slab preparation, and exterior finishing remaining. Andy Mest, who supervised Greystar's initial modular projects in the U.K., including the world's two tallest modular residential structures at 38 and 44 stories in London, highlighted the company's success in integrating U.K. experiences into their U.S. operations.

While the current focus is on the Mid-Atlantic region, Greystar envisions expanding its modular manufacturing to other parts of the U.S. in the future.