POSSIBLE INCREASE IN REAL ESTATE EXCISE TAX

The house local government committee will consider HB 1628 On Tuesday, February 7 at 10:30 am. The bill would increase the real estate excise tax from 3% to 4% on transactions of $5 million and above. Proponents claim it will only affect wealthy homeowners but as drafted would affect most multifamily real estate as well. A 4% Real Estate excise tax would be the highest in America. If you live in and own property in Washington State, you are encouraged to contact your state legislator. Click here to take action or watch Tuesday's hearing live.

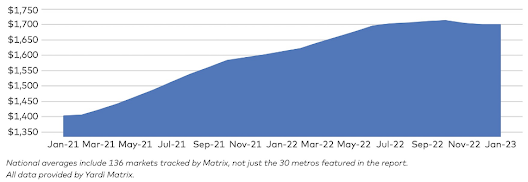

RENT GROWTH FORECAST FOR PUGET SOUND 2023

Rent growth in Seattle has been reported as increasing by 8% year over year, according to Zumper and the Puget Sound Business Journal. However, Yardi Matrix is forecasting a slowdown in rent growth to 3% this year. This slowdown is attributed to the anticipation of the completion of 137,000 new units in the development pipeline for King, Pierce, Kitsap, and Snohomish counties, which is expected to increase the housing supply in the area. The increase in supply may impact the demand for rental properties, resulting in slower rent growth. This year’s actual rent growth will depend on various factors such as economic conditions, population growth, and job market trends.

MORE BILLS

The Washington State legislature has introduced multiple bills this session that aim to address housing concerns among constituents. Some of the proposals would allow for denser development, while others would impose limits on rent hikes and require more notice of rent increases. These bills reflect a growing concern among many constituents about being able to afford and maintain stable housing in the face of rising costs.

One of the bills being considered in the house would require a six-month notice for rent increases of more than 5%, and it would give tenants the right to break their leases to avoid those rent hikes. Currently, a 60-day notice is required for rent increases, and the proposed bill would increase this to six months. The bill would also cap late fees at $75. The proposed legislation reflects a desire among some lawmakers to address concerns about housing affordability and stability, but it faces opposition from those who believe it will not solve the root causes of the housing crisis and could have unintended consequences for the housing market.

House Bill 5060 would require landlords to register their rental properties and publish the rents for each unit. The state would charge a fee of $70 for the first unit and $15 for each additional unit, including all vacant units. Landlords who fail to register would not be allowed to evict tenants for reasons other than a nuisance, illegal activity, or substantial interference with the use of the property. The state plans to use the fees collected to fund rental housing inspection programs and to provide attorneys to tenants facing eviction. Some landlords are concerned that this bill could be a precursor to a tax on vacant properties. The bill would not apply in Seattle or other cities that already require a business license for rental properties, but those cities would need to report their data to the state and may also be required to begin collecting rent data.

The outcome of these bills, and their potential impact on housing in Washington, will depend on various factors such as economic conditions and real estate market trends. The legislature has only until early March to pass bills out of the chamber where they were introduced if they expect to make them law.

Against the backdrop of a current shortage of 150,000 housing units and a projected need for 1 million total units by 2043, a bipartisan group of lawmakers in Washington State has announced their support for 13 bills aimed at increasing the state's housing stock. Governor Inslee's proposed budget includes plans to borrow $4 billion to fund a push for housing construction.

The proposals from the bipartisan group of lawmakers include:

- Speeding up permitting by setting deadlines for permit review and requiring local governments to refund permit fees if they don't meet those deadlines

- Making it easier to develop mother-in-law units

- Allowing lots of more than 1,500 square feet to be split for new housing

- And exempting first-time homebuyers from the real estate tax on townhomes and condos

These proposals aim to address the housing shortage in the state and make housing more affordable and accessible to residents.

BILLS TO INCREASE DENSITY NEAR TRANSIT, ESPECIALLY WHERE PROHIBITED ENTIRELY AT THIS TIME

Washington HB 1517 and SB 5466 are aiming to increase housing density near rapid transit in Washington. The bills are intended to address the current zoning restrictions in some areas that include high parking requirements, no residential use, or zoning only for single-family homes. Senator Marko Liias has stated that his constituents are more supportive of housing near transit than rezoning for missing middle housing, indicating the ongoing debate about balancing the need for affordable housing and preserving existing neighborhoods. The goal of the legislation is to make it easier for people to live near public transportation and reduce their reliance on cars, which can help address the state's housing shortage and promote sustainability. The House Bill was introduced by representative Julia Reed.

HOME IN TACOMA

Meanwhile, in Tacoma, a new report by The Urbanist, says this year is expected to be a significant one for Tacoma's housing policy. The city has multiple projects underway aimed at making its communities more vibrant, accessible, and healthy. As the Puget Sound region's population is expected to grow by over 5 million people in the next 13 years, Tacoma's portion of that growth is forecasted to be 125,000 people, an increase of over 50% from 2021. There are both supporters and opponents of Tacoma's evolving housing policy, including the "Don't Seattle My Tacoma" group and the pro-housing "Home in Tacoma for All Coalition." These groups have different views on the direction the city's housing policy should take, reflecting the ongoing debate about affordable housing and the need for a balance between development and preservation.

SOME DEMOCRATS PUSHING PRESIDENT BIDEN TO ADD FEDERAL RENT CONTROL

The recent discussions about rent control in Washington and changes to Oregon's rent control laws are happening in the context of the Federal Government's involvement in the issue. According to a report from the Wall Street Journal Editorial Board, there are around 50 Democrats who are pushing President Biden to impose some form of national rent control structure or what they are calling price gouging protections. The individuals advocating for these measures are proposing to link rent caps with providing federal funds to house the homeless. This reflects the growing concern about affordable housing and the desire for action at the national level to address the issue.

CMBS LOAN DEFAULTS REMAIN LOW

And although it has been expected we would see some loans on multifamily properties in default due to variable rates or other situations, Trepp reports that the CMBS delinquency rate has defied doom and gloom expectations by falling in January below 3% overall. Multifamily delinquency rates fell below the 12-month average of 1.81% to 1.56.

.jpeg)