Congratulations to HFO broker Lee Fehrenbacher and the rest of the HFO team on the sale of eight-unit Pierson Place Apartments in Beaverton, OR.

The latest news of interest to multifamily owners of apartment buildings in Oregon and Washington.

Build Your Legacy with HFO, a member of GREA.

Congratulations to HFO broker Lee Fehrenbacher and the rest of the HFO team on the sale of eight-unit Pierson Place Apartments in Beaverton, OR.

According to the most recent available rent data from the U.S. Census Bureau's American Community Survey, the Portland-Vancouver-Hillsboro, OR-WA, Seattle-Tacoma-Bellevue, WA, and Olympia-Lacey-Tumwater, WA metro areas are among the top 50 regions with the highest rents in the nation.

The Center Square published an analysis of the data showing the Portland metro area at 29th on the list, the Seattle metro at 14th, and the Olympia metro at 38th.

Read more at TheCenterSquare.com.

WalletHub has listed Oregon ninth on its 2022 list of the best and worst state economies, falling slightly from eighth on the list in 2021.

The company's rankings are determined by examining 28 key indicators of economic performance and strength, from GDP growth to startup activity to the share of jobs in high-tech industries.

However, Oregon ranks behind Washington for best overall performance in the Pacific Northwest. While Oregon performed well in terms of potential innovation, coming in at seventh nationwide, the state fell to 15th in sub-rankings for economic health and 23rd for economic activity.

Oregon's 2022 WalletHub Rankings

Congratulations to HFO brokers Jack Stephens and Stephen Wendt and the rest of the HFO team on the sale of the six-unit property at 6839 N Fessenden Street in Portland, OR.

"Investors should look to whether apartment rent growth continues to outpace inflation. Apartments’ typically shorter lease terms are uniquely positioned to re-price rents during inflationary periods to offset rising costs (including the rising cost of capital due to higher rates)."

Read more at NMHC.org

Driven by efforts to address the statewide lack of housing and slow the effects of climate change, Oregon is set to adopt new permanent land-use rules in July that will do away with minimum parking requirements for homes and businesses in the eight most populous metro areas, the Oregonian reports.

"In both Oregon and California, eliminating minimum parking mandates is seen as a way of encouraging compact, climate-friendly communities that address severe housing shortages by making it easier, safer, and more affordable to live and work without a car."

The article cites a Parking Reform Network study that found the cost of building individual parking spots starts at $20,000 for surface lots and can surpass $60,000 for underground garages. This cost is absorbed into the costs of building homes or businesses and is passed off in rent, and land is devoted to parking that could instead be used to build more desperately needed housing.

The new rules are part of a greater effort dubbed Climate-Friendly and Equitable Communities rulemaking that was launched following an executive order by Gov. Kate Brown instructing state agencies to slow greenhouse gas emissions and address the affordable housing crisis. Under these rules, Oregon's eight most populous metros — Portland, Salem-Keizer, Albany, Corvallis, Central Lane, Bend, Middle Rogue, and Rogue Valley — to

"change their local transportation and land use plans to do more to ensure Oregonians have more safe, comfortable ways to get around, and don’t have to drive long distances just to meet their daily needs. The rules also aim to improve equity, and help community transportation, housing, and planning."

These changes, the Department of Land Conservation and Development explains, "ask cities to designate climate-friendly areas and to allow people to build taller buildings providing more housing."

Read the Oregonian's coverage at OregonLive.com, and download more information about Climate-Friendly and Equitable Communities rulemaking at Oregon.gov.

JPMorgan Chase Head of Commercial Real Estate Al Brooks published his mid-year outlook for multifamily real estate this month, noting that rising single-family housing prices and mortgage rates have led renters to stay in their homes longer.

“Performance metrics remain tight, with asking and effective rents posting near-record highs in the first quarter of 2022. The new record is 8.1% effective rent growth in the third quarter of 2021 — more than three times the prior record of 2.4% set in the third quarter of 2001.”

Brooks also notes that demand for workforce housing is likely to remain strong as demand for affordable housing trails national supply.

"There can be upfront costs to modernize dated apartment units. However, the demand for these units may outweigh those minimal costs."

Read more at JPMorgan.com.

RealPage analytics reports that although inflation is casting doubt on the U.S. economy, the red-hot rental market continues unabated. "Rent growth reached another record high in May, as did renter incomes," the company said.

With the largest rent increases in pricier class A and B apartment units, new lease rate changes (trade outs) are rising fast. Renters renewing leases in the same unit continued to see big discounts compared to new renters.

Markets with the steepest rents for new tenants are:

Congratulations to HFO broker Adam Smith and the rest of the HFO team on the sale of the 10-unit multifamily property at 810-828 14th Street NE, Salem, OR 97301!

Seattle Mayor vetoes City Council's attempted overreach into landlord's private business information; Rents are up as the housing market cools a bit, but Washington state remains tops in rankings for best places for millennials and pretty much anyone else.

Seattle Mayor vetoes City Council's attempted overreach into landlord's private business information; Rents are up as the housing market cools a bit, but Washington state remains tops in rankings for best places for millennials and pretty much anyone else.

Seattle's Mayor Bruce Harrell vetoed a City Council plan to require landlords to provide financial information on their rental units to a research institution. The plan was estimated to cost between $2 and $5 million with no identified funding source in a year when Seattle is facing a budget shortfall.

In his veto letter to the City Council, the mayor attached a detailed letter from James Young, the Director of the University of Washington Center for Real Estate Research which stated in part, the following:

"As someone who has spent their career collecting and analyzing house price and rent data, the goal of collecting highly granular rental and vacancy data is laudable. However, my concern is that the legislation as drafted will not yield the level of quality of data the City requires. This is because the legislation lacks two key data collection elements crucial to success. These are:

The Oregon Housing Blog reports that as of July 1, there are upcoming rent changes allowed under Oregon's new minimum wage.

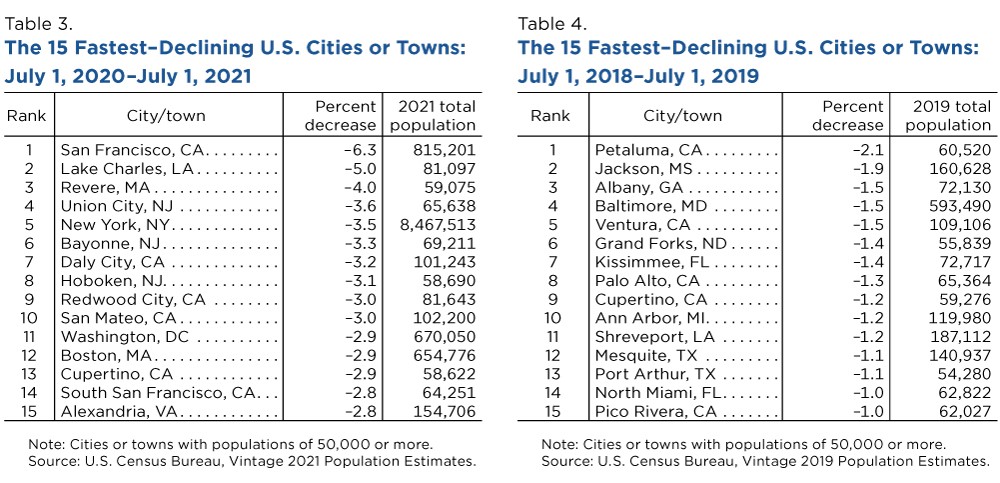

U.S. Census Bureau population estimates released late last month show eight of the 10 largest cities in the U.S. saw population declines in the first year of the pandemic.

Despite not ranking in the top 15 in 2019, San Francisco led the way in 2021 with a loss of almost 55,000 residents, or 6.3% of its 2020 population.

|

| Images via www.census.gov |

However, experts interviewed by the Daily Journal of Commerce note the recent data fails to capture those who have returned to urban areas in the past year as cities and workplaces reopen. Brookings Institution demographer William Frey is quoted as saying he believes the population losses in most of the largest U.S. cities from 2020 to 2021 have been “short-lived and pandemic-related.”

Read more at Census.gov and DJCOregon.com.

Congratulations to the HFO team!

Last week, the Portland City Council unanimously approved updates to the city’s Residential Infill Project, allowing more types of housing to be built on lots originally zoned for one home and setting new rules for building configuration and maximum size.

The original bill passed in 2019 effectively ended single-family zoning in large Oregon cities, allowing duplexes, triplexes, fourplexes, and “cottage clusters” to be built on parcels previously reserved for single-family houses in cities with more than 25,000 residents and allowing duplexes in single-family zones as in cities with at least 10,000 residents.

“It’s not adequate to our current housing shortage and displacement problems, but it’ll make these problems easier to solve both in the short and long term,” Michael Andersen, a senior researcher with the sustainability think tank Sightline Institute, tells The Oregonian. “It’s not going to make homelessness disappear in 2023, but it is going to reduce homelessness in 2050. And it’ll make all of our problems less difficult in 2022.”

Residential Infill Project Updates Effective July 1st

Developers can build:

Mark Zandi, chief economist at Moody’s Analytics, told Fortune magazine last week that the U.S. housing boom has ended, and we have entered a "housing correction."

"In terms of home sales, they're falling sharply. Housing demand is coming down fast. Home price growth [will] go flat here pretty quickly; we will see [home] price declines in a significant number of markets," Zandi says.

This "correction" will result in flat annual home price growth over the next year, the top economist predicts. Fortune notes this would be the intentional result of mortgage rate hikes meant to decelerate inflation by ending the housing boom and slowing construction. While the article reassures readers homeowners are better off financially than in 2008 and we won't face another foreclosure crisis, it provides analysis of which markets are "overvalued" and will likely see home prices drop between 5%-10% over the next year, or 10%-20% in the event of a recession.

Read the article and view the state-by-state map of where regional home prices are overvalued at Fortune.com.