Yardi Matrix is out with a new report on multifamily housing. Here are the highlights:

Construction Pipeline Falling

- Construction financing is in short supply, likely significantly reducing deliveries between 2025-2027. This coincides with a similar report from RealPage.

- Regulatory costs account for 40% of multifamily development costs with high-cost jurisdiction oblivious to the drag on construction. Political will to address the housing shortage may be finally turning as municipalities realize their fees are a drag on supply

| |||

| Click to enlarge |

- The supply shortage in U.S. housing is likely to last up to 10 more years, supporting rent growth and capital appreciation.

Transactions Slowing

- Transactions have and will continue to slow until inflation is under control and interest rates come down, which Yardi predicts will happen Q3 2024.

- Initial pre-distress and distress is emerging.

Occupancy Flat

- Remote work has led people to move outside urban areas to larger units with more amenities.

- Oregon and Washington are among the top three states offering flexible work, with 86% of companies allowing work-from-home. Technology, media, insurance, professional and financial services are among the most likely to allow work-from-home.

Population Aging

- The US population will grow older for the next several decades, with Boomers retiring, but will fare better than much of the world. China has the fastest aging society in human history. Japan and parts of Europe will also suffer.

Rent Growth Slowing to Pre-Pandemic Levels

- National multifamily rent growth is strong but decelerating. Rent growth recovered faster in tech hubs than gateway markets.

- Renting is still a better deal than owning, due to the high cost of interest and rising home prices

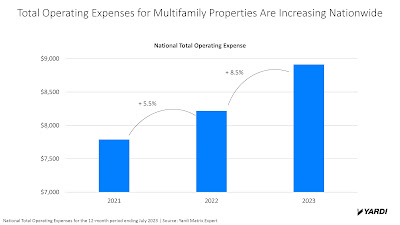

Operating Expenses Climbing Fast

- Operating expenses for multifamily properties are increasing nationwide, up 5.5% in 2022 and 8.5% in 2023.

- Portland's operating expenses are up 10% in 2023

- Seattle's operating expenses are up 5.5% in 2023

|

| Click to enlarge |

No comments:

Post a Comment

Thanks for your comment! It has been sent to the moderator for review.