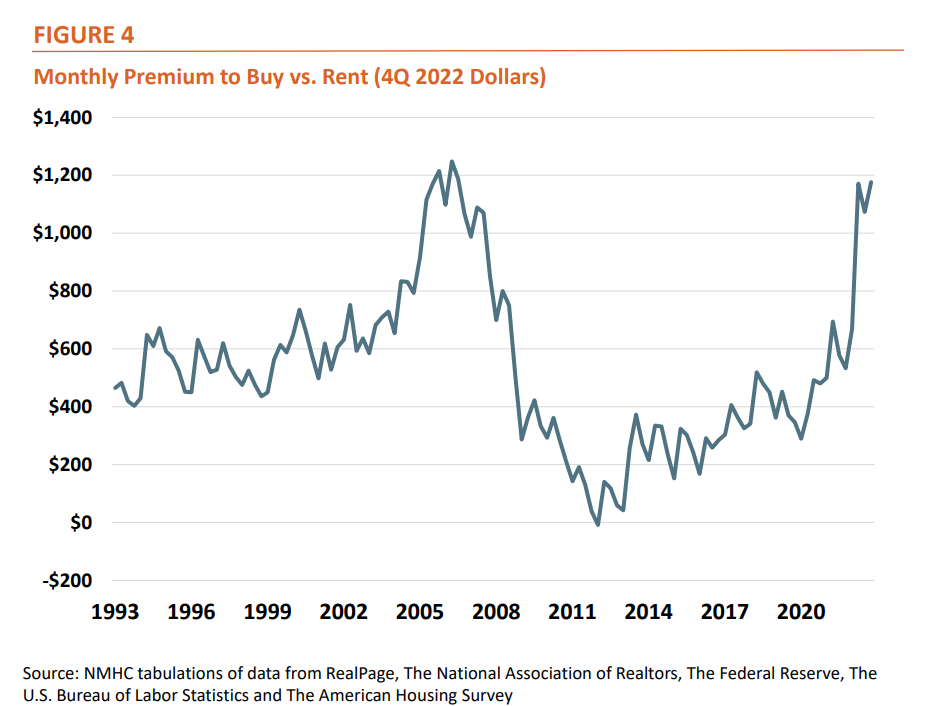

According to NMHC estimates, by Q4 2022, the monthly cost of owning a home was $1,176 higher than renting a professionally managed apartment. This marks the largest buy-to-rent premium, adjusted for inflation, since Q3 2006 — the peak of the housing bubble.

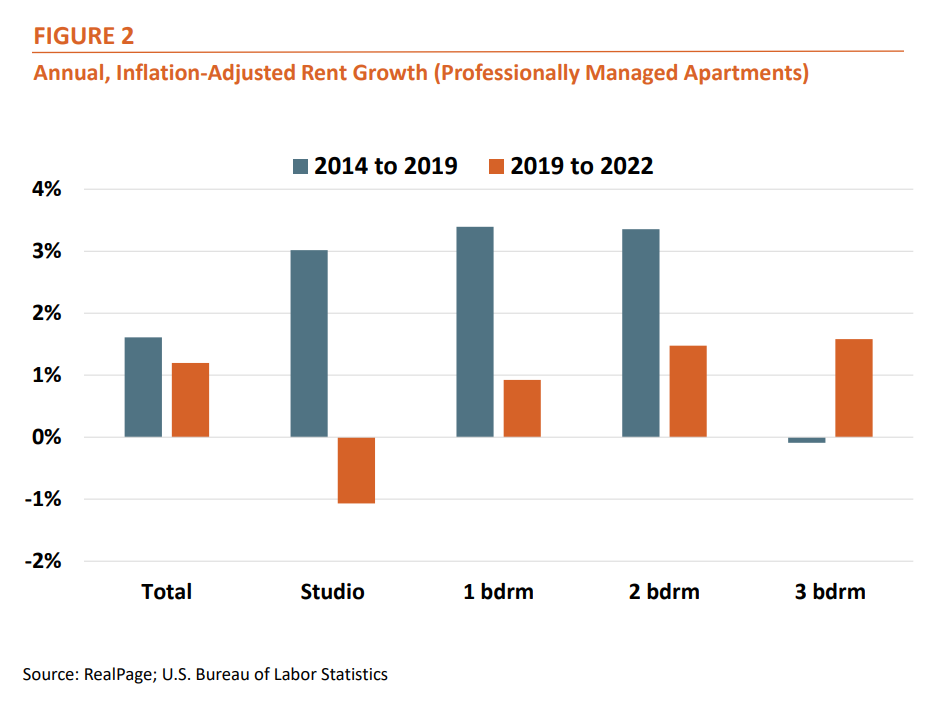

After adjusting for inflation, the annual rent growth rate for professionally managed apartments tracked by RealPage has decreased in recent years, with an average rate of just 1.2% between Q4 2019 and Q4 2022. This is down from the average rate of 1.6% over the previous five years, indicating a reduction in the amount by which rent growth exceeds inflation, writes NMHC Senior Director of Research Chris Bruen in a recent analysis.

Since the outbreak of COVID-19, inflation has surged, with prices for goods and services increasing by an average annual rate of 5% between Q4 2019 and Q4 2022. This is significantly higher than the average rate of 1.7% recorded between 2014 and 2019.

"When we fail to build enough housing, housing costs rise. Not only does this place an increasing burden on American households, but it also contributes to higher overall inflation (housing accounts for a full 40% of core CPI). And, when we fail to address inflation on the supply side, the Federal Reserve must curb demand through raising interest rates. This results in higher mortgage costs for home buyers and a higher cost of capital for builders, which further contributes to our nation’s supply shortage."

Read more at NMHC.org.

No comments:

Post a Comment

Thanks for your comment! It has been sent to the moderator for review.