Brookshire Apartments is an 18-unit complex comprising four four-plexes and an original 1950s house converted into a duplex. Tucked away in Newport on the Oregon coast, the benefits of the property's desirable location were challenged by the need for various capital improvements, and several vacant units were not yet rent-ready. With occupancy below 70% at the time of sale, there was potential for management improvement. HFO assisted the buyer in navigating the complexities of financing for this operationally challenged property in a tertiary location. This transaction exemplifies HFO's adeptness and expertise in successfully closing challenging deals.

Multifamily Apartment Investor News Blog | Rental Owners in Oregon and Washington

The latest news of interest to multifamily owners of apartment buildings in Oregon and Washington.

Build Your Legacy with HFO, a member of GREA.

Friday, April 26, 2024

Wednesday, February 7, 2024

2024 Multifamily Housing Market: A Year of Cautious Optimism and Stabilization

By HFO Investment Real Estate

Research

Following partner meetings with

dozens of institutional multifamily owner groups at the National Multifamily

Housing Conference in San Diego last month, it appears the multifamily housing

sector is entering a period of cautious optimism in 2024. For the most part,

institutional owners, whose multifamily assets are typically valued at $20

million and up, feel the prices of multifamily real estate are finding their

floor. Key factors contributing to this outlook include better clarity on

interest rates, operational costs, and the balance between supply and demand,

suggesting a more predictable market landscape. There's also a growing

acceptance that distress among institutional-grade properties will be minimal,

with many issues likely to be resolved privately or through debt restructuring.

The financial dynamics of

multifamily properties are evolving. Expense growth is expected to surpass

revenue increases in some markets this year. Property values are approaching a

low-water mark, with capitalization rates stabilizing. These dynamics suggest a

cautious market, with big-ticket investors adjusting their expectations. The

cautious market is expected to keep joint venture and institutional equity

mostly sidelined, with the bulk of capital investment in housing this year

coming from family offices and private individuals. A surprising and

significant increase in expenses the rental housing market faces is a surge in

fraudulent rental applications. According to an NMHC report released in

mid-January, more than 70% of major apartment landlords report increased

applications, highlighting a growing and significant issue impacting

operational costs and market integrity. This trend complicates rental

management and contributes to higher costs, ultimately affecting availability

and affordability.

With loan rates and expenses

up, construction starts are declining nationwide, including throughout the

Portland metro. Most of the area's new apartments will be delivered this year,

and there is very little slated for completion in 2025 compared to other

markets in the western region. This decline in new construction is occurring

despite a critical need for more housing. A strong job market, increasing

wages, and growing consumer confidence further increase demand. With

completions up in the near term, the strategy of "heads on beds"

emphasizing occupancy over rent increases still reflects the competitive

landscape, with operators willing to adjust prices to maintain high occupancy

rates. However, that strategy will end as construction deliveries slow later

this year. CoStar Analytics is now forecasting that rent increases will begin

again in the fourth quarter of 2024.

The government at all levels

now appears serious about addressing the need for additional housing. Last

week, the City of Portland issued largely temporary "regulatory

relief" on 15 zoning and permitting requirements that take effect March 1.

At the state level, Governor Tina Kotek recently announced she would seek $500

million during the current legislative session for housing-related

infrastructure and land-use expansions. At the federal level, a new bill

introduced in Congress on January 31 would spend $300 million to enhance the

supply of affordable housing.

In summary, the multifamily

housing market in 2024 is navigating through a phase of adjustment and cautious

optimism. Demand remains strong, but the challenges of supply, construction,

and operational dynamics persist. The introduction of legislation to bolster

the affordable housing supply and the need to address fraud in rental

applications are critical aspects of the broader effort to stabilize and

improve the market for renters and investors.

HFO Investment Real Estate is celebrating its 25th year

in business. HFO offers brokerage and advisory services to multifamily owners in

Oregon and Washington. Call (503) 241-5541 or visit www.hfore.com to learn more.

Thursday, November 9, 2023

Sold! 52 Units in Tigard, OR

We're thrilled to announce the successful sale of Tigard York, a 52-unit garden-court apartment community in the heart of Tigard, a vibrant westside suburb of Portland. Kudos to Greg Frick, Rob Marton, and Tyler Johnson for navigating this complex transaction and helping a 1031-exchange buyer secure funding, showcasing HFO's ability to secure a successful outcome for all parties even amidst market challenges. 🚀💼

Check out more recent HFO transactions at HFORE.com.

Thursday, September 28, 2023

Citizens’ Initiative 2023-01: How Your Vote Could Impact Tacoma's Rental Landscape

On August 30th, a significant decision was made regarding Tacoma's rental housing landscape. A judge ruled against including the already-passed Measure No. 2, which expanded renter protections, on the November ballot as an alternative to the proposed "Citizens’ Initiative 2023-01." The Tacoma City Council had voted to include Measure No. 2 on the ballot as an alternative to the initiative, despite it being an existing law that wouldn't be impacted by the results of the vote.

Ballots will be mailed out on October 20th.

What is Citizens’ Initiative 2023-01?

The initiative aims to further refine the city's rental housing code, introducing more comprehensive rights for tenants than those provided by Measure No. 2.

Here are some of the proposed changes under the initiative:

Resident Fees:

- Move-in fees capped at one month, encompassing only a screening fee and a 25% pet fee.

- Late fees restricted to a maximum of $10/month.

- Rent increase notifications become more stringent, requiring two notices: one between 6-7 months and another between 3-4 months prior.

Relocation Assistance:

- Rent increases below 7.5% will necessitate a payment to the tenant of 2x the monthly rent.

- Increases between 7.5% and 10% will require 2.5x the monthly rent.

- Any increase above 10% will require a relocation fee of 3x the monthly rent.

- Notably, there will be no appeal process or means testing.

Eviction Limitations:

- Evictions during the school year will be prohibited for students, educators, and school associates.

- A winter eviction ban will be in place from November 1st to April 1st.

- A new category of protected renters will be introduced, safeguarding groups like the military, first responders, seniors, healthcare providers, educators, and their residing family members from eviction.

What Does This Mean for Multifamily Investors and Owners?

The potential passage of Citizens’ Initiative 2023-01 could introduce a more regulated environment for multifamily property owners and investors. The restrictions on fees, the stringent requirements for rent increases, and the broadened eviction limitations could impact operational flexibility and profitability. It's crucial for stakeholders to be informed and prepared for these changes should the initiative pass.

What Can Multifamily Investors and Owners do to Make Their Voices Heard?

Stay tuned for more updates and in-depth analyses on this topic. If you're a multifamily investor or owner, understanding the nuances of such measures can be pivotal for your investment strategy.

Tuesday, September 26, 2023

Analysis Finds Owning a Home 70% More Costly Than Renting

Recent analysis by the real-estate technology platform Cadre reveals that for many Americans, renting might be the more economical choice given the skyrocketing costs of homeownership. With mortgage rates surpassing 7% and home prices at an all-time high, combined with fierce competition due to limited home listings, potential buyers are finding homeownership increasingly out of reach.

A comparison of owning versus renting costs shows the most significant disparity since 2000, with it being approximately 70% more expensive to buy a home than to rent as of August 2023.

Key Highlights:

- Mortgage rates are over 7%, and home prices are elevated.

- In July 2023, it was 62% more expensive to buy than rent.

- Cadre's analysis indicates a 70% cost difference between owning and renting in August 2023, the widest gap since 2000.

- The median home price in the U.S. in July stood at $406,700.

- Median rent in August was $2,052, while the estimated median monthly mortgage payment was $2,632 in September.

Read more at MarketWatch.com.

Friday, September 22, 2023

Yardi Matrix Trends Report: Transactions, Pipeline, Rents, Occupancy, and Operating Expenses

Yardi Matrix is out with a new report on multifamily housing. Here are the highlights:

Construction Pipeline Falling

- Construction financing is in short supply, likely significantly reducing deliveries between 2025-2027. This coincides with a similar report from RealPage.

- Regulatory costs account for 40% of multifamily development costs with high-cost jurisdiction oblivious to the drag on construction. Political will to address the housing shortage may be finally turning as municipalities realize their fees are a drag on supply

| |||

| Click to enlarge |

- The supply shortage in U.S. housing is likely to last up to 10 more years, supporting rent growth and capital appreciation.

Transactions Slowing

- Transactions have and will continue to slow until inflation is under control and interest rates come down, which Yardi predicts will happen Q3 2024.

- Initial pre-distress and distress is emerging.

Occupancy Flat

- Remote work has led people to move outside urban areas to larger units with more amenities.

- Oregon and Washington are among the top three states offering flexible work, with 86% of companies allowing work-from-home. Technology, media, insurance, professional and financial services are among the most likely to allow work-from-home.

Population Aging

- The US population will grow older for the next several decades, with Boomers retiring, but will fare better than much of the world. China has the fastest aging society in human history. Japan and parts of Europe will also suffer.

Rent Growth Slowing to Pre-Pandemic Levels

- National multifamily rent growth is strong but decelerating. Rent growth recovered faster in tech hubs than gateway markets.

- Renting is still a better deal than owning, due to the high cost of interest and rising home prices

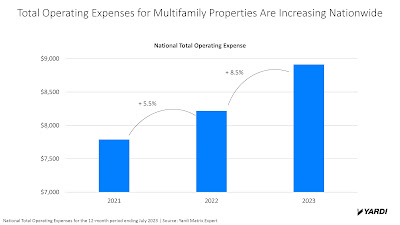

Operating Expenses Climbing Fast

- Operating expenses for multifamily properties are increasing nationwide, up 5.5% in 2022 and 8.5% in 2023.

- Portland's operating expenses are up 10% in 2023

- Seattle's operating expenses are up 5.5% in 2023

|

| Click to enlarge |

Wednesday, September 20, 2023

Portland City Council Greenlights Tax Incentive to Boost Downtown Business

The Portland City Council has unanimously approved a tax incentive aimed at retaining businesses in the city's downtown, Old Town, and Lloyd and Lower Albina districts. This credit, designed to reduce business license taxes, is available to companies with a minimum of 15 employees that sign or extend a lease for at least four years in the specified urban areas. To qualify, businesses must also ensure that their employees spend at least half their working hours in the city core. While the incentive caps at $250,000 per taxpayer, it's expected to be implemented for the 2023 tax year. City officials believe that even though smaller businesses might not directly benefit from the tax break, the increased foot traffic from larger businesses will indirectly boost their operations.

Andrew Fitzpatrick, the mayor's economic development director, and Andrew Hoan, president of the Portland Metro Chamber, both stressed the importance of the incentive in preventing businesses from leaving the city. Mayor Ted Wheeler and Commissioner Carmen Rubio, who played pivotal roles in formulating the measure, expressed optimism about its potential positive impact on the city's business landscape.

Key Highlights of the DBI Credit:

- Eligibility Criteria:

- Sign a new or renewed lease during 2023 or 2024 for a minimum of four years or own and occupy a building within the eligible sub-districts.

- Retain a minimum of 15 employees who work at least half-time in the leased/owned building throughout the four-year duration.

- Credit Amount:

- Maximum credit per taxpayer: $250,000, spread equally over four years starting from the year of origin (either 2023 or 2024).

- The credit amount is the lesser of (in the year of origin):

- 100% of the City of Portland Business Tax liability

- 1% of City of Portland “income subject to tax”

- $30 per square foot of leased building space

- Additional Provisions:

- The city can set further limits on individual taxpayer credits if the total credits applied for surpass the $25 million DBI credit pool.

- Annual attestation is mandatory over the four-year credit period.

- Failure to meet requirements results in repayment of the credit with interest.

Read more at Portland approves downtown business tax break - Portland Business Journal (bizjournals.com)

Monday, September 11, 2023

The Future of Housing? Greystar Modular Home Factory Puts Out

Dive Insight reveals that Ltd. Spring Run, constructed from over 880 prefabricated modules, will span six residential buildings on a 24-acre plot. These units will be almost fully finished upon arrival, with only utilities, slab preparation, and exterior finishing remaining. Andy Mest, who supervised Greystar's initial modular projects in the U.K., including the world's two tallest modular residential structures at 38 and 44 stories in London, highlighted the company's success in integrating U.K. experiences into their U.S. operations.

While the current focus is on the Mid-Atlantic region, Greystar envisions expanding its modular manufacturing to other parts of the U.S. in the future.

Friday, September 8, 2023

New Eugene Rental Housing Laws Now in Effect

On July 24, 2023, the Eugene City Council passed Ordinance Number 20694, amending various sections of the Eugene Code related to rental housing, effective August 25, 2023.

Click here to read and download a copy of the complete ordinance.

Key Highlights:

- Security Deposits: Landlords can't ask for more than two months' rent as a security deposit. However, additional deposits may be required for things like pets or special circumstances, but renters must be given at least three months to pay these extra deposits.

- Applications: Landlords must clearly state when they start accepting rental applications. They also need to record the date and time they receive each application, and process them in the order they're received. If someone needs more time to apply, they can request it, and the application date will be adjusted accordingly.

- Relocation Assistance: If a landlord ends a month-to-month tenancy without cause, they must give at least 90 days' notice and provide relocation assistance equal to two months' rent. Similar rules apply in case of a qualifying landlord reason. For fixed-term tenancies, renters can request to renew their agreement within 30 days, or the landlord may offer a renewal. If the rent increases by the maximum allowed by law (10% for 2023), renters can request relocation assistance.

- Rent Increases: If rent increases by the maximum allowed by law, renters can ask for relocation assistance within 30 days of receiving the notice. The landlord must pay it at least 45 days before the increase takes effect.

- Reporting Requirements: Landlords must report certain actions, like termination notices and legal actions, to the city within 30 days.

- Exemptions: These rules don't apply to week-to-week tenancies, some owner-occupied situations, certain types of housing, or if rent increases are below the maximum allowed by law.

- Enforcement and Penalties: Landlords who violate these rules may have to pay relocation assistance, damages, and attorney fees to renters. There are also penalties for not following security deposit and screening rules.

Please note that this summary is for informational purposes and not legal advice. Consult an attorney for specific guidance on rental housing matters. For more details and updates, visit the City of Eugene's website.

Report: CPI Likely to Continue to Falling as Flat and Declining Rents Impact Future Reports

ApartmentList.com is well known for its meticulous and transparent analysis of U.S. rental market trends. Their recent studies highlight the relationship between U.S. inflation trends and changes in the apartment market.

Impact of Rent on Inflation:

- In 2021 and 2022, post-pandemic rent increases significantly influenced the rise in overall consumer prices.

- Rent is a major consumer expense; thus, an increase in rent leads to higher inflation.

Comparison with Official Data:

- There's a discrepancy between market data (like that from ApartmentList.com) and the rental price inflation used by the Bureau of Labor Statistics (BLS) for the official consumer price index (CPI).

- Market rent changes influence the CPI but with a slight delay.

- ApartmentList.com's data can predict how rent changes will impact the official inflation rate in upcoming months.

Chart Significance:

The chart compares ApartmentList.com's rental inflation estimate, the BLS's rent inflation estimate, and the overall CPI.

|

| Click to Enlarge |

Insight from Rob Warnock of ApartmentList.com:

- The Apartment List National Rent Index is a robust precursor for the CPI housing and rent components.

- In 2021, when their index showed a record rent growth of 17.8%, the CPI's rent component was just beginning to rise.

- By 2023, while their index indicates a cooling rental market for a year, the CPI housing component has only recently peaked.

- Although the CPI's housing inflation remains high, the overall inflation has considerably decreased.

- As the CPI housing component starts to reflect this cooling trend, it will further reduce overall inflation in the coming months.

Current Rental Market Trends:

- Rents are decreasing in most U.S. markets.

- 72 out of the 100 largest markets have reported year-over-year declines.

- This decline is supported by factors like the completion of new apartments and a vacancy rate returning to pre-pandemic levels.

Future Outlook:

- The data suggests promising improvements in housing affordability in the upcoming year.

- This will also result in decreased headline inflation rates.