The latest news of interest to multifamily owners of apartment buildings in Oregon and Washington.

Build Your Legacy with HFO, a member of GREA.

Wednesday, November 30, 2022

Sold! 32 Units in Portland, OR

Tuesday, November 29, 2022

NMHC: Three Ways Policymakers Can Reduce Barriers to Housing Development

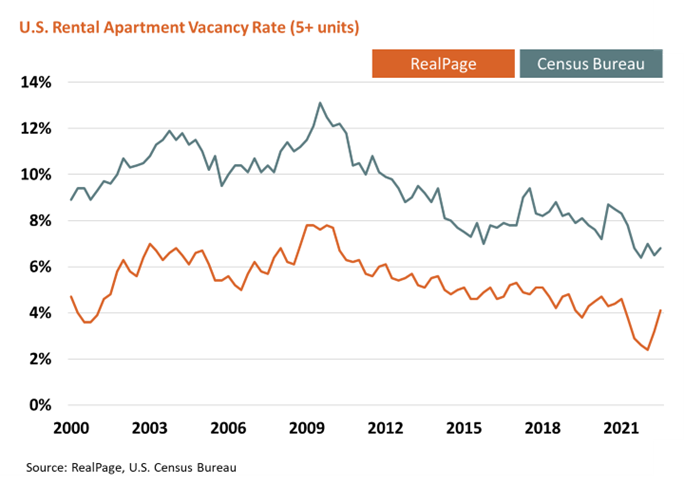

Despite insufficient housing supply, vacancies are increasing, the National Multifamily Housing Council (NMHC) reports in a recent post. "Households are doubling up, moving back home, or deciding not to create new households at all," according to NMHC, citing RealPage data showing annual rent growth from the first quarter of 2022 through the third moderated from 15.3% to 10.5%, while rents decreased for the past two consecutive months.

However, they caution, this doesn't mean we should ignore the desperate need for housing nationwide. "Long-term, however, apartment demand is expected to rebound with improved economic confidence, which means we need to keep building new housing despite this temporary lull if we want to avoid large rent increases in the future."

The group urges long-term thinking beyond quick fixes like rent control and eviction moratoriums, which the post's authors point out don't address the underlying supply shortage. To affect real change, landlords and lawmakers must work together, they remind, suggesting the federal government can encourage development to meet the housing shortage by:

- Expanding and enacting federal tax credit programs that ease development affordability, like the Low-Income Housing Tax Credit and the Middle-Income Housing Tax Credit;

- Reforming and increasing funding for subsidy programs that address housing affordability, including HOME, Section 8, FHA Multifamily and CDBG; and

- Providing regulatory relief to reduce development and operating costs by tying other federal dollars (like transportation funding) to incentivizing localities to reduce parking and other land use requirements, streamline the development and approval process and restrict the use of rent control and mandatory inclusionary zoning.

|

| via NMHC | Rising Rents? Blame the Supply Shortage |

Read

Tuesday, November 22, 2022

High Employment Rates and Massive Income Growth: Oregon State Economist Josh Lehner's Reasons to be Thankful

- Employment rates by educational attainment in Oregon are higher today than they were pre-pandemic and are the highest seen since before the Great Recession or the dotcom bust.

via OregonEconomicAnalysis.com - According to just-released 2021 county and metro income data, personal income growth in Oregon’s metros has outpaced the rest of the nation. Grants Pass, Bend, Salem, Albany, and Medford were all among the U.S. metros that saw the 10% strongest increases in income.

|

| via OregonEconomicAnalysis.com |

- New data through the second quarter from both the Federal Reserve and the JP Morgan Chase Institute show that low- and moderate-income households are still doing well financially. Checking account balances remain strong and show no deterioration across the distribution.

Newmark: Negative Multifamily Demand in Q3 2022

According to Newmark's Third Quarter 2022 United States Multifamily Capital Markets Report:

- Quarterly absorption posted net negative demand of 82,035 units nationally in the third quarter of 2022, during the historically active leasing months of July, August and September, where absorption was negative.

- Nationally, vacancies remain near historic lows of 3.1% on a trailing 12-month basis; however, quarter-over-quarter vacancies have risen 90 basis points as demand has trailed off recently.

- While multifamily remains the most sought-out property type, accounting for 41.7% of all US commercial real estate year-to-date, sales volume in the third quarter of 2022 declined 17.2% year-over-year, to $74.1 billion. Compared with the first three quarters of 2021, sales volume has increased 25.0% and deal size continues to escalate.

Monday, November 21, 2022

Multifamily Marketwatch: Washington Podcast - Carl Whitaker of Real Page Analytics and Blake Hering of Gantry Inc with updates on Data and Debt

Carl Whitaker, Director of Research and Analysis for RealPage Analytics offers an update for the Pacific Northwest multifamily market, and Blake Hering of Gantry, Inc. provides a lending market update.

Tuesday, November 15, 2022

RealPage: October Rent Cut is the Third Largest Since 2010

RealPage, Inc.'s Jay Parsons explains the drop is due in part to the pandemic having disrupted traditional seasonal leasing patterns over the past two years. "It's returning this year at an outsized pace... giving back some of the gains from the past two years," Parsons writes. "It's very clear that peak rent growth is way in the rearview mirror (summer 2021) and even in an upside scenario, we're likely to see more normal-ish numbers in 2023."

Visit RealPage.com for the full report.

Monday, November 14, 2022

Report: Pandemic Significantly Increased Multnomah County's Homeless Population

The number of people identified as homeless increased 30% from 2019 to 2022, according to a recently released report from the Multnomah County Joint Office of Homeless Services.

As part of a federally required annual survey, more than 2,000 people facing homelessness were asked if COVID-19 was a reason for their homelessness. Twenty-four percent of them answered "yes."

The most recent count, conducted on Jan. 26, 2022, found that 5,228 people in Portland and Multnomah County were experiencing homelessness, of which 58.5% were unsheltered, 28.4% were in emergency shelters, and 13.1% were in transitional housing.

Although Black, Indigenous and other people of color represent just 34.3% of the Multnomah County population, 38.9% of the homeless people surveyed identified as BIPOC.

|

| Source: 2022 Point-in-Time Count of People Experiencing HUD Homelessness in Portland/Gresham/Multnomah County, Oregon on January 26, 2022 | Multnomah County Joint Office of Homeless Services |

The data mostly likely represents only a portion of the unsheltered population in Portland, the report notes, citing the difficulty of "finding and surveying everyone who is living unsheltered in a week's time."

Read the full report here.

Portland Asking Rents Slightly Above National Average

Portland’s multifamily sector showed steady improvement in 2022, according to the early autumn report for Portland released by Yardi Matrix

Overall asking rent in the Portland metro increased to $1,759, slightly above the $1,718 nationwide rate. On an annual basis, rates in Portland were up 9.9%. Lake Oswego (11.3% annual growth to $2,436 per month) and the Pearl District (3% annual growth to $2,121 per month) remained the most expensive areas.

Saturday, November 12, 2022

Portland City Council Votes to Adopt Housing Plan & Camping Ban, and Mayor Wheeler Proposes $27M "Down Payment" for Sanctioned Camps

The City Council directed city bureaus and council offices to work together to identify policy and regulatory adjustments, investments, and public-private partnerships to catalyze the production of 20,000 units of affordable housing by 2033. The council also directed these agencies to "pursue immediate actions to reduce the cost of building housing in Portland that is affordable to middle- and lower-income residents." For more details on last week's resolution, visit Portland.gov.

During Thursday's fall budget adjustment work session, Mayor Wheeler proposed an immediate $27 million city budget down payment to help build the approved camping sites.

Proposed funds included campsite preparation and construction costs, as well as staffing salaries, a city-employee Navigation Team "to increase connection with individuals experiencing homelessness and available services," private security contracts "for surrounding neighborhoods and business districts of designated camping locations," expanded staffing for the City Incident Command team, and additional funding for the Impact Reduction Program.

The council will vote on all proposed budget adjustments next Thursday, Nov. 17th.

For more information, visit Portland.gov.

Wednesday, November 9, 2022

Portland Employment Growing "Fairly Fast"

Portland employment grew 5.2% in the 12 months ending in September, "fairly fast compared to the 50-largest metropolitan areas nationally," writes Workforce Analyst/Economist for Multnomah County Jake Procino in the most recent Multnomah County Economic Indicators report.

The city also passed an important milestone this summer, according to Procino, having recovered all of the jobs lost in early 2020 by July 2022. Meanwhile, Portland's September unemployment rate of 3.6% was nearly equal to the national rate of 3.5%.

Read the full report at QualityInfo.org, the Oregon Employment Department's workforce and economic information website.

Monday, November 7, 2022

Multifamily Marketwatch: Washington Podcast - Washington State and U.S. Multifamily News Headlines

Featured this week: The latest headlines from multifamily news in Washington State and the U.S.

Wednesday, November 2, 2022

Portland Ranked 21st Among Major U.S. Cities for Crime Rates

According to a recent analysis by the Portland Business Journal (PBJ), in terms of major crime rates, Portland is relatively average compared to the 40 markets in which Business Journals are published.

PBJ reporters examined per capita murders, assaults, and robberies in these markets in the first half of 2022 to rank from lowest (denoting less per capita crime) to highest. Portland ranked 21st.

Compared to the same period in 2021, murders in Portland were down to 41 from 48, while the number of aggravated assaults dropped to 1,619 from 1,675.

Overall Rankings:

1. Boston

2. Austin

3. Raleigh

4. San Jose

5. Columbus

6. Jacksonville

7. Tampa

8. Charlotte/Mecklenburg County, North Carolina

9. New York

10. Miami

11. San Francisco

12. Honolulu

13. Wichita

14. Seattle

15. Orlando

16. Pittsburgh

17. Cincinnati

18. Los Angeles

19. Phoenix

20. San Antonio

21. Portland

22. Minneapolis

23. Sacramento

24. Louisville

25. Denver

26. Buffalo

27. Washington, D.C.

28. Dallas

29. Atlanta

30. Nashville

31. Chicago

32. Kansas City

33. Philadelphia

34. Albuquerque

35. Houston

36. Cleveland

37. St. Louis

38. Milwaukee

39. Memphis

40. Baltimore

Visit BizJournals.com/Portland to learn more about the individual metrics used to create the ranking.